Insurance policies Development

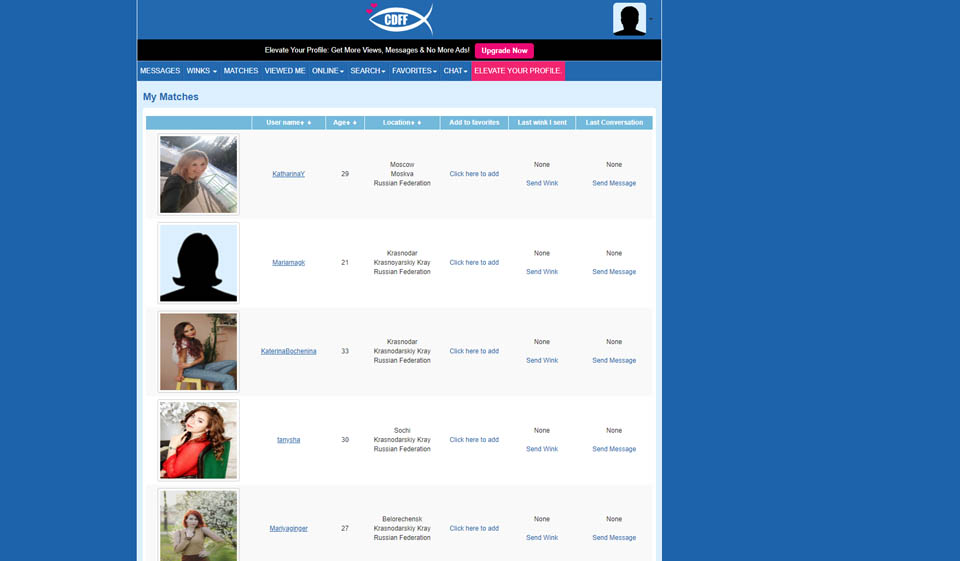

Relationship programs was interested in knowing the preferences and needs off some one and you can connecting these with an effective fits in the same way agents line up their clients on proper insurance companies.

This new begin-up Coverboo are banking on being an insurance matchmaker, having fun with colorful looks and Tiktok-keep in touch with attract a special age bracket regarding users.

Speaking to Insurance coverage Team, Trevor McIntosh (pictured), chairman and you can https://kissbridesdate.com/chinese-women/jinan/ maker out of Coverboo, said the business’s branding was in response to a great lack of difference in the business.

There are not any insurance rates brokerages seeking explore more recent pop society recommendations to tell the insurance coverage story, said McIntosh, that invested more twenty years doing work for the Canada’s better insurance firms.

There can be a promising generation regarding Gen Zs, without a person’s expenses far focus on them. Discover a giant options right here just like the an agent first off building a bridge with this age group, become willing to give them the insurance situations it you need after they you prefer all of them.

The fresh sight is always to has a phenomenon otherwise a person travels one really does imitate a matchmaking software, where you do only swipe left and right for specific things, told you McIntosh. We have a beneficial hyper-standard form of which now, and what that can appear to be is determining your circumstances due to a rhythm one to decorative mirrors good Tinder swiping experience.

Insurance gladly actually immediately following

Ahead of establishing Coverboo in the , McIntosh offered once the vice-president away from functions within Zensurance, a Toronto-situated insurtech. The guy also invested big date during the BrokerLink and you may Intact.

McIntosh’s desire to own Coverboo and originated in discussions with family members the guy sensed address consumers. He came up with Coverboo due to the fact a play on boo, slang for an intimate mate otherwise a buddy, plus the acronym regarding boutique, the kind of provider the guy wanted to promote customers.

Many people remember advertising as what they get a hold of towards the web site, the fresh colour and all you to definitely jazz. But for me, they surrounds the company’s label in addition to form of feel some one should expect when getting your, McIntosh told you.

I spent much time building attract organizations with my family members whom very own people, vehicles, home, all of that good things, and you will seeking to learn its records to insurance policies brokerages. How could you approach you to definitely dialogue having fun with a great deal more untraditional words one to you will resonate far more which have particular somebody and people?

Once the a retail broker that is fully on the web, entirely digital, i separate our selves of the trying to debunk nearly all what individuals may think insurance brokers are only concerned with. I you will need to do this during the a light-hearted, enjoyable ways.

The difficulties regarding undertaking an insurance broker

Given that opening store inside middle-2023, Toronto-founded McIntosh could have been trying to develop the brokerage solo with the help of a part-date operations movie director and a digital purchases associate. not, he could be trying to bring about producers starting in March.

As an online broker, McIntosh actually marketed to the notion of going the fresh brick-and-mortar however, desires give Coverboo’s to help you more customers using people pop-ups.

Even with their feel and you may associations in the business, their love of insurance rates, along with his invention, McIntosh acknowledge there had been tall challenges during the starting an agent.

Discover a reason there’s not plenty of creativity happening into the the space nowadays, and it’s really because the barriers to help you entryway was next to impossible if you are not available to this new hustle, he told you.

I became a tiny naive whenever i been which excursion during the the sense you to definitely since I have received a great amount of identification in the industry having works you to definitely You will find over, and You will find had certain very strong associations with plenty of the major companies, I imagined it’d feel relatively simple for me to go aside and possess people contracts.

However, today, all business desires $one million otherwise $dos billion, date you to definitely. No one wants to talk to you if you are a-start-upwards brokerage and never a producer who has got you to $5 mil in order to $six mil publication that will commit frequency in it away from day you to. This really is deflating.

Having McIntosh, the industry need to have even more information to compliment business owners from the techniques plus the swinging pieces of carrying out an insurance broker. Although not, revealing his experience doing Coverboo with individuals has also been satisfying.

Nothing is I enjoy over with those individuals talks rather than gatekeeping my education, discussing it which have as many individuals when i is also allow them to try to initiate their particular insurance policies companies as well.